UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

BIOANALYTICAL SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required.

No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) | Title of each class of securities to which transaction applies: | |

2) | Aggregate number of securities to which transaction applies: | |

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

4) | Proposed maximum aggregate value of transaction: | |

5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

1) | Amount Previously Paid: | ||

2) | Form, Schedule or Registration Statement No.: | ||

3) | Filing Party: | ||

4) | Date Filed: | ||

SEC 1913 (02-02) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||

Shareholders of Bioanalytical Systems, Inc.:

You are invited to attend the Annual Meeting of Shareholders of Bioanalytical Systems, Inc. (“BASi”) to be held Thursday, February 26, 2004,15, 2007, at 10:00 a.m. (EST) at BASi headquarters located at 2701 Kent Avenue, West Lafayette, Indiana.

At the meeting, shareholders will vote on the election of sixfive persons to the Board of Directors, and the ratification of the selection of Ernst & Young LLP as independent auditors for the current year.Directors. Details can be found in the accompanying Notice of Annual Meeting and Proxy Statement.

We hope you are able to attend the Annual Meeting personally, and we look forward to meeting with you. Whether or not you currently plan to attend, please complete, date and return the proxy card in the enclosed envelope. The vote of each shareholder is very important. You may revoke your proxy at any time before it is voted by giving written notice to the Secretary of BASi, by filing a properly executed proxy bearing a later date or by attending the Annual Meeting and voting in person.

On behalf of the Board of Directors and management of BASi, I sincerely thank you for your continued support.

| Sincerely, Bioanalytical Systems, Inc. Peter T. Kissinger, Ph.D. Chairman and Chief Scientific Officer |

[LOGO]

BIOANALYTICAL SYSTEMS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD FEBRUARY 26, 200415, 2007

To the Shareholders of Bioanalytical Systems, Inc.:

The Annual Meeting of Shareholders of Bioanalytical Systems, Inc. (“BASi”) will be held at the principal executive offices of BASi, at 2701 Kent Avenue, West Lafayette, Indiana 47906 on Thursday, February 26, 200415, 2007 at 10:00 a.m. (EST) for the following purposes:

(a) To elect directors of BASi to serve for a one-year term; (b) to ratify the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as independent auditors for BASi for the fiscal year ending September 30, 2004; and (c)

(a) | To elect five directors of BASi to serve for a one-year term; and |

(b) | to transact such other business as may properly come before the meeting. |

Holders of BASi common shares of record at the close of business on December 31, 20032006 are entitled to notice of, and to vote at, the Annual Meeting.

By Order of the Board of Directors,Candice B. KissingerSecretaryJanuary 23, 2004

By Order of the Board of Directors, | |

Candice B. Kissinger | |

Secretary | |

January 17, 2007 | |

West Lafayette, Indiana |

YOUR VOTE IS IMPORTANT. IF YOU DO NOT EXPECT TO ATTEND THE

ANNUAL MEETING, OR IF YOU DO PLAN TO ATTEND BUT WISH TO VOTE

BY PROXY, PLEASE DATE, SIGN AND PROMPTLY MAIL THE ENCLOSED PROXY.

A RETURN ENVELOPE IS PROVIDED FOR THIS PURPOSE.

2

[LOGO]

BIOANALYTICAL SYSTEMS, INC.

, PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD FEBRUARY 26, 200415, 2007

General Information

This proxy statement is furnished in connection with the solicitation by the Board of Directors of BASi of proxies to be voted at the Annual Meeting of Shareholders to be held at 10:00 a.m. (EST) on Thursday, February 26, 2004,15, 2007, and at any adjournment thereof. The meeting will be held at the principal executive offices of BASi, 2701 Kent Avenue, West Lafayette, Indiana 47906. This proxy statement and the accompanying form of proxy were first mailed to shareholders on or about January 27, 2004.17, 2007.

A shareholder signing and returning the enclosed proxy may revoke it at any time before it is exercised by delivering written notice to the Secretary of BASi, by filing a properly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. The signing of a proxy does not preclude a shareholder from attending the Annual Meeting in person. All proxies returned prior to the Annual Meeting, and not revoked, will be voted in accordance with the instructions contained therein. Any proxy not specifying to the contrary will be voted (1) FOR the election of each of the nominees for director named below, and (2) FOR the proposal to ratify the selection of Ernst & Young LLP as independent auditors for BASi for the fiscal year ending September 30, 2004.below. Abstentions and broker non-votes are not counted for purposes of determining whether a proposal has been approved, but will be counted for purposes of determining whether a quorum is present.

As of the close of business on December 31, 2003,2006, the record date for the Annual Meeting, there were outstanding and entitled to vote 4,869,5024,892,127 common shares of BASi. Each outstanding common share is entitled to one vote. BASi has no other voting securities outstanding. Shareholders do not have cumulative voting rights.

A quorum will be present if a majority of the outstanding common shares are present, in person or by proxy, at the Annual Meeting. If a quorum is present, the nominees for director will be elected by a plurality of the votes cast and the independent auditors will be approved by a majority of the votes cast.

A copy of the BASi Annual Report and Form 10-K, including audited financial statements and a description of operations for the fiscal year ended September 30, 2003,2006, accompanies this proxy statement. The financial statements contained in the Annual Report and Form 10-K are not incorporated by reference in this proxy statement. The solicitation of proxies is being made by BASi, and all expenses in connection with the solicitation of proxies will be borne by BASi. BASi expects to solicit proxies primarily by mail, but directors, officers and other employees of BASi may also solicit proxies in person or by telephone.

3

Proposals for 20052008 Annual Meeting

Shareholder proposals to be considered for presentation and inclusion in the proxy statement for the 20052008 Annual Meeting of Shareholders must be submitted in writing and received by BASi on or before September 29, 2004.28, 2007. If notice of any other shareholder proposal intended to be presented at the 20052008 Annual Meeting of Shareholders is not received by BASi on or before December 13, 2004,14, 2007, the proxy solicited by the Board of Directors of BASi for use in connection with that meeting may confer authority on the proxies to vote in their discretion on such proposal, without any discussion in the BASi proxy statement for that meeting of either the proposal or how such proxies intend to exercise their voting discretion.

The mailing address of the principal offices of BASi is 2701 Kent Avenue, West Lafayette, Indiana 47906.

Beneficial Ownership of Common Shares

The following table sets forth certain data with respect to those persons known by BASi to be the beneficial owners of five percent or more of the outstanding common shares of BASi as of December 31, 2003,2006, and also sets forth such data with respect to each director of BASi, each officer listed in the Executive Compensation table (on(beginning on page 76 of this proxy statement), and all directors and executive officers of BASi as a group. Except as otherwise indicated in the notes to the table, each beneficial owner possesses sole voting and investment power with respect to the common shares indicated.

| Name(1) | Number | Percent | ||||

|---|---|---|---|---|---|---|

| Peter T. Kissinger(2) | 1,282,755 | 26 | .2% | |||

| Ronald E. Shoup(3) | 100,966 | 2 | .1% | |||

| Candice B. Kissinger(4) | 1,282,755 | 26 | .2% | |||

| William E. Baitinger(5) | 150,634 | 3 | .1% | |||

| Leslie B. Daniels(6) | 38,042 | 0 | .8% | |||

| W. Leigh Thompson(7) | 5,500 | 0 | .1% | |||

| Michael P. Silvon(8) | 4,500 | 0 | .1% | |||

| Eleven executive officers and directors as a group(9) | 1,804,070 | 36 | .8% | |||

1

Beneficial Ownership of Common Shares

| Name(1) | Shares Owned | Shares Owned Jointly | Shares/ Options Owned Beneficially | Options Exercisable Within 60 Days of December 21, 2006 | Total | % | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Peter T. Kissinger(2) | 430,947 | 595,910 | 268,310 | — | 1,295,167 | 25 | .2% | ||||||||||||||

| Candice B. Kissinger(2) | 250,956 | 595,910 | 432,301 | 16,000 | 1,295,167 | 25 | .2% | ||||||||||||||

| William B. Baitinger(3) | — | 146,512 | — | 10,000 | 156,412 | 3 | .1% | ||||||||||||||

| David W. Crabb | — | — | — | — | — | — | |||||||||||||||

| Ronald E. Shoup(3) | 451 | 88,517 | — | 27,000 | 115,968 | 2 | .3% | ||||||||||||||

| Leslie B. Daniels(4) | 38,042 | — | 31,175 | — | 69,217 | 1 | .3% | ||||||||||||||

| Michael R. Cox | — | — | — | 37,500 | 37,500 | 0 | .7% | ||||||||||||||

| Edward M. Chait | — | — | — | 37,500 | 37,500 | 0 | .7% | ||||||||||||||

| Richard M. Shepperd | 750 | — | — | — | 750 | — | |||||||||||||||

| 10 Executive Officers and | |||||||||||||||||||||

| Directors as a Group | 723,810 | 847,528 | 31,175 | 149,250 | 1,734,517 | 33 | .8% | ||||||||||||||

| (1) | All addresses are in care of BASi at 2701 Kent Avenue, West Lafayette, Indiana |

| (2) | Shares beneficially and jointly owned by |

| (3) | Shares owned jointly by Mr. Baitinger’s and Dr. |

| (4) | Shares beneficially owned |

4

1. ELECTION OF DIRECTORS

Nominees

The Bylaws of BASi provide for no fewer than seven and no more than nine directors, each of whom is elected for a one-year term. The terms of all incumbent directors will expire at the Annual Meeting. The Nominating Committee of the Board of Directors has nominated all of the following current directors for re-election at the Annual Meeting. The directors nominated for re-election are:

•Meeting: Peter T. Kissinger, • Ronald E. Shoup, • Candice B. Kissinger, • William E. Baitinger, • David W. Crabb and Leslie B. Daniels and • W. Leigh Thompson

(collectively,(collectively, the “Nominated Directors”). Following the recent resignation of John A. Kraeutler, theThe Board of Directors has determined that each of the Nominated Directors, other than Peter T. Kissinger and Candice B. Kissinger, is conducting a searchan “independent director” as defined in the applicable rules of the NASDAQ Stock Market. There are two vacancies on the board at this time, and the Nominating Committee is searching for two new directors.qualified individuals to fill the vacancies. The Board of Directors expects to fill these vacancies in due course.

The Board of Directors recommends that shareholders vote FOR the election of all of the Nominated Directors and, unlessDirectors. Unless authority to vote for any Nominated Director is withheld, the accompanying proxy will be voted FOR the election of all the Nominated Directors. However, the persons designated as proxies reserve the right to cast votes for another person designated by the Board of Directors in the event any Nominated Director becomes unable to serve or for good cause will not serve. Proxies will not be voted for more than sixfive nominees. If a quorum is present, those nominees receiving a plurality of the votes cast will be elected to the Board of Directors.

The directors of BASi as of December 31, 2003, who are alsofollowing table shows certain information about the Nominated Directors, are as follows:Directors:

| Name | Age | Position | Served as Director Since | Name | Age | Position | Served as Director Since | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Peter T. Kissinger, Ph.D. | 59 | Chairman of the Board President; Chief Executive Officer | 1974 | |||||||||||

| Ronald E. Shoup, Ph.D. | 52 | Chief Operating Officer, BASi Contract Research Services; Director | 1991 | |||||||||||

| Peter T. Kissinger, Ph.D | 62 | Chairman of the Board; Chief Scientific Officer | 1974 | |||||||||||

| Candice B. Kissinger | 52 | Senior Vice President; Director of Research; Director | 1978 | 55 | Senior Vice President; Director of Research; Director | 1978 | ||||||||

| William E. Baitinger | 70 | Director | 1979 | 72 | Director | 1979 | ||||||||

| David W. Crabb | 53 | Director | 2004 | |||||||||||

| Leslie B. Daniels | 56 | Director | 2003 | 59 | Director | 2003 | ||||||||

| W. Leigh Thompson, Ph.D., M.D. | 65 | Director | 1997 | |||||||||||

52

Business Experience of Nominated Directors

Peter T. Kissinger, Ph.D.founded BASi in 1974 and has served as its Chairman, President and Chief Executive Officer since 1974.from that time until September, 2006. In September, 2006, Dr. Kissinger resigned the position of President and Chief Executive Officer, and assumed the role of Chief Scientific Officer. He is also a part-time Professor of Chemistry at Purdue University, where he has been teaching since 1975. Dr. Kissinger has a Bachelor of Science degree in Analytical Chemistry from Union College and a Ph.D. in Analytical Chemistry from the University of North Carolina.

Ronald E. Shoup, Ph.D. serves as Chief Operating Officer of BASi’s Contract Research Services and is Managing Director of BAS Analytics, Ltd. in the UK. He joined BASi in 1980 as an applications chemist, became Research Director in 1983 and launched the Contract Research services group within BASi in 1988. Dr. Shoup has a Bachelor of Science degree in Mathematics and Chemistry from Purdue University and attended Michigan State and Purdue University for his Ph.D. in Analytical Chemistry. He has served on BASi’s Board of Directors since 1991 and is a member of the external advisory board to the Purdue University Department of Chemistry.

Candice B. Kissinger currently devotes all of her time to branding, client relationship management, sales, product development, and managing installation and service for in vivo products and services, principally the Culex® ABS. She was named has been Senior Vice President Marketing inof BASi since January 2000 and is currently also serves as Director of Research. From 1981 to 2000 she served as Vice President, International SalesShe has obtained for BASi U.S. and Marketing.international patents for BASi products including Raturn, Culex, linear microdialysis probe, Empis automated drug infusion system and Chads for Vials with additional patents pending. Ms. Kissinger has a Bachelor of Science degree in Microbiology from Ohio Wesleyan University and a Master of Science degree in Food Science from the University of Massachusetts. She has served as a director and Secretary of BASi since 1978.

William E. Baitinger has served as a director of BASi since 1979. Mr. Baitinger was Director of Technology Transfer for the Purdue Research Foundation from 1988 until 2000. In this capacity he was responsible for all licensing and commercialization activities from Purdue University. He currently serves as Special Assistant to the Vice President for Research at Purdue University. Mr. Baitinger has a Bachelor of Science degree in Chemistry and Physics from Marietta College and a Master of Science degree in Chemistry from Purdue University.

David W. Leigh Thompson, Ph.D.,Crabb, M.D., has served as a director of BASi since January 1997. Since 1995, Dr. ThompsonFebruary 2004. He has been Chief Executive OfficerChairman of Profound Quality Resources, Inc., a scientific consulting firm. Prior to 1995, Dr. Thompson was Professorthe Indiana University Department of Medicine at Case Western Reservesince 2001. Previously he had served as Chief Resident of Internal Medicine and on the Medicine and Biochemistry faculty of Indiana Universities, PresidentUniversity. He was appointed Vice Chairman for Research for the department and later Assistant Dean for Research. Dr. Crabb serves on several editorial boards. He is Director of the SocietyIndiana Alcohol Research Center funded by NIAAA. He was a recipient of Critical Care Medicinean NIH Merit Award and Chief Scientific Officer at Eli Lillynumerous other research and Company. He earned a Bachelor of Science degree in Biology from the College of Charleston, a Master of Science and a Ph.D. in Pharmacology from the Medical University of South Carolina, a Medical Doctor degree from The Johns Hopkins University and was awarded a Ph.D. of Science from the Medical University of South Carolina. Dr. Thompson is also a director of La Jolla Pharmaceutical Company, Diabetogen, Bioscience, Inc., Medarex, Inc., Guilford Pharmaceuticals, Inc., Inspire Pharmaceuticals, Inc., Sontra Medical Corp. and DepoMed, Inc.teaching awards.

6

Leslie B. Daniels joined the BASi Board of Directors in 2003. He was a director of PharmaKinetics Laboratories, Inc., acquired by BASi inJuly 2003. Mr. Daniels is a founding partner of CAI, a private equity fund in New York City. He previously was President of Burdge, Daniels & Co., Inc., a principal in venture capital and buyout investments as well as trading of private placement securities, and before that, a Senior Vice President of Blyth, Eastman, Dillon & Co. where he had responsibility for the corporate fixed income sales and trading departments. Mr. Daniels is a former Director of Aster-Cephac SA, IVAX Corporation, MIM Corporation, Mylan Laboratories, Inc., NBS Technologies Inc. and MIST Inc. He was also Chairman of Zenith Laboratories, Inc. and currently serves as Chairman of Turbo Combustor Technology Inc. and as a Director of SafeGuard Health Enterprises, Inc.

Scientific Advisory Board3

In 1985, BASi established a Scientific Advisory Board to assist BASi in its research and development activities. The Scientific Advisory Board is comprised of distinguished scientists from outside BASi who have significant accomplishments in areas of science and technology that are important to BASi’s future. The Scientific Advisory Board interacts with BASi’s scientific and management staff. Each member of the Scientific Advisory Board is employed outside BASi and may have commitments to, or consulting or advisory contracts with, other entities that may conflict or compete with his or her obligations to BASi. Generally, members of the Scientific Advisory Board are not expected to devote a substantial portion of their time to BASi matters. Members of the Scientific Advisory Board do not receive any compensation in connection with attending meetings of the Scientific Advisory Board. They do, however, from time to time, receive compensation in connection with consulting services they render to BASi.

Family Relationships

Peter T. Kissinger and Candice B. Kissinger are husband and wife. There is no other family relationship among the directors and executive officers of BASi.

Compensation of Directors

Directors who are not employees of BASi receive $1,500$2,000 for each Board meeting attended, plus out-of-pocket expenses incurred in connection with attendance at such meetings. Directors of BASi or an affiliate of BASi who are not employed by BASi or any affiliate may also participate in the BASi 1997 Outside Director Stock Option Plan, as may be approved from time to time by the Compensation Committee. Options were issued to William E. Baitinger and W. Leigh Thompson in fiscal 2003, in the amount of 9,000 shares each. Directors who are employees of BASi do not receive any additional compensation for their services as directors.

7

Certain Relationships and Transactions

Leslie B. Daniels, a director of the Company currently up for reelection, was a director of PKLB at the time it was acquired by the Company in June 2003. As a result of that acquisition, Mr. Daniels received a 6% convertible subordinated note in the amount of $498,809 due January 1, 2008 (the “6% Note”), in exchange for Series A Convertible Preferred Shares of PKLB which he held at the effective time of the acquisition. The 6% Note is convertible at any time after June 30, 2004, into a total of approximately 31,175 of the Company’s common shares. In addition, prior to the acquisition of PKLB, Mr. Daniels made various loans to PKLB totaling $350,000. These loans were consolidated into a $350,000 promissory note which was convertible into shares of common stock of PKLB (the “PKLB Note”). On December 31, 2003, BASi Maryland, Inc. (the former PKLB) assigned the PKLB Note to the Company. On that same date, the Company issued a $350,000 8% convertible note (the “New Note”) to Mr. Daniels in exchange for the PKLB Note, which was cancelled. The New Note matured on June 1, 2005 and was convertible into the Company’s common shares at a price based upon the market price of the Company’s common shares at or about the time of conversion. Immediately following the issuance of the New Note on December 31, 2003, the Company prepaid $100,000 of the outstanding principal amount of the New Note, plus approximately $31,000 in accrued interest, and Mr. Daniels converted $150,000 of the principal amount of the New Note into 38,042 of the Company’s common shares. Following the payment and conversion, the Company issued a new 8% convertible note due June 1, 2005, to Mr. Daniels on substantially the same terms as the New Note for the remaining $100,000 principal amount.

Committees and Meetings of the Board of Directors

The Board of Directors has established Compensation and Incentive Stock Option, Audit, and ExecutiveNominating Committees. Scheduled meetings are supplemented by frequent informal exchange of information and actions taken by unanimous votes without meetings.

No member of the Board of Directors attended fewer than 75% of the meetings of the Board of Directors and meetings of any committee of the Board of Directors of which he or she was a member. FourThree out of sixfive members of the Board of Directors attended the 20032006 Annual Meeting of shareholders. All of the members of the Board of Directors are encouraged, but not required, to attend BASi’s annual meetings. The following chart shows the number of meetings of each of the committees of the Board of Directors and meetings of the Board of Directors at which a quorum was present:

| Committee | Members | Meetings in | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Compensation and Incentive Stock Option | William E. Baitinger | ||||||||||

| 2 | |||||||||||

| Leslie B. Daniels | |||||||||||

| David W. Crabb | |||||||||||

| Audit | William E. Baitinger | ||||||||||

| 5 | |||||||||||

| Leslie B. Daniels | |||||||||||

| David W. Crabb | |||||||||||

| Nominating | William E. Baitinger | 0 | |||||||||

| David W. Crabb | |||||||||||

| Leslie B. Daniels | |||||||||||

| Board of Directors | 5 | ||||||||||

84

TheCompensation and Incentive Stock Option Committee makes recommendations to the Board of Directors with respect to:

• compensation arrangements for the executive officers of BASi,

• policies relating to salaries and job descriptions,

• insurance programs,

• benefit programs, including retirement plans,

• administration of the 1990 and 1997 Employee Incentive Stock Option Plans, and

• the 1997 Outside Director Stock Option Plan.

TheAudit Committee is responsible for:

• reviewing with the auditors the scope of the audit work performed,

• establishing audit practices,

• establishingoverseeing internal accounting controls,

• reviewing financial reporting, and

• accounting personnel staffing.

The Board of Directors has adopted a written charter for the Audit Committee.Committee, a copy of which is included as attachment A to BASi’s Proxy Statement for fiscal 2005. Audit Committee members are not employees of BASi and, in the opinion of the Board of Directors, are “independent” (as defined by Rule 4200(a)(15) of the NASD listing standards). The Board of Directors has determined that Leslie B. Daniels is an “audit committee financial expert” (as defined by Item 401(h) of Regulation SK)S-K) and is “independent” (as defined by Item 7(d)(3)(iv) of Schedule 14A).

TheExecutive Committee may exercise all of the authority of the Board of Directors, subject to certain limitations with respect to payment of dividends, filling of vacancies on the Board, amendment of the Articles of Incorporation or Bylaws, approval of significant corporate transactions, issuance of shares and other matters specified under Indiana law. The Executive Committee did not meet during fiscal 2003.

The Board of Directors has noNominating Committee. Nominees is responsible for receiving and reviewing recommendations for nominations to the Board of Directors and recommending individuals as nominees for election to the Board of Directors. Nominating Committee members are not employees of BASi and, in the opinion of the Board of Directors, are currently selected“independent” (as defined by rule 4200 (a) (15) of the entire Board of Directors.NASD listing standards). The Board of Directors will considerhas not adopted a written charter for nomination asthe Nominating Committee.

Shareholders of BASi may nominate directors persons recommended by shareholders. Such recommendationsproviding timely notice thereof in proper written form to the Secretary of BASi. To be timely, a shareholder’s notice to the Secretary must be in writing and delivered to Bioanalytical Systems, Inc., Attention: Corporate Secretary, 2701 Kent Avenue, West Lafayette, Indiana 47906. The NASD has adopted new rules regardingor mailed and received at the process for selecting nomineesprincipal executive offices of BASi (a) in the case of an annual meeting, not less than ninety days nor more than one hundred twenty days prior to the Boardanniversary date of Directors. These new NASD rules are effective asthe immediately preceding annual meeting; and (b) in the case of a special meeting of shareholders called for the purpose of electing directors, not later than the close of business on the tenth day following the day on which notice of the date of the Annual Meetingspecial meeting was mailed or public disclosure of the date of the special meeting was made, whichever first occurs.

To be in proper written form, a shareholder’s notice to the Secretary must set forth (a) as to each person whom the shareholder proposes to nominate for election as a director (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class or series and number of shares of capital stock of BASi which are owned beneficially or of record by the person, and (iv) any other information relating to the person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the ”Exchange Act”), and the rules and regulations promulgated thereunder; and (b) as to the shareholder giving the notice (i) the name and record address of such shareholder, (ii) the class or series and number of shares of capital stock of BASi which are owned beneficially or of record by such shareholder, (iii) a description of all arrangements or understandings between such shareholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such shareholder, (iv) a representation that such shareholder intends to appear in person or by proxy at the meeting to nominate the persons named in its notice, and (v) any other information relating to such shareholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. Such notice must be accompanied by a written consent of each proposed nominee to being named as a nominee and to serve as a director if elected.

5

The chair of the Nominating Committee or his or her designee shall have the authority to determine whether a nomination is properly made in accordance with the foregoing procedures. If the chair of the Nominating Committee or his or her designee determines that a nomination was not made in accordance with the foregoing procedures, the chairman of the meeting shall declare to the meeting that the nomination was defective and such defective nomination shall be disregarded.

There is no fixed process for identifying and evaluating potential candidates to be nominees for directors, and there is no fixed set of qualifications that must be satisfied before a candidate will be considered. Rather, the Nominating Committee has the flexibility to consider such factors as it deems appropriate. These factors may include education, diversity, and experience with business and other organizations comparable with BASi, the interplay of the candidate’s experience with that of other members of the Board of Directors, isand the extent to which the candidate would be a desirable addition to the Board of Directors and to any of the committees of the Board of Directors. The Nominating Committee will evaluate nominees for directors submitted by shareholders in the process of reviewing its nominating procedures to ensure that BASi issame manner in compliance withwhich it evaluates other director nominees. No shareholder has properly nominated anyone for election as a director at the new rules on a timely basis.Annual Meeting.

9

Executive Compensation

The following table sets forth information with respect to the aggregate compensation paid during each of the last three fiscal years to BASi’s President and Chief Executive Officer and each of the other executive officers of BASi whose total compensation exceeded $100,000 during fiscal 20032006 (the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| Fiscal Year | Salary | Bonus | All Other Compensation | Options Granted | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Peter T. Kissinger, Ph.D | 2006 | $ | 108,284 | — | $ | 27,801 | (1) | — | |||||||||

| Chairman of the Board, | 2005 | $ | 107,674 | — | $ | 27,756 | (1) | — | |||||||||

| Chief Scientific Officer | 2004 | $ | 24,000 | — | $ | 27,380 | (1) | — | |||||||||

| Richard M. Shepperd(4) | 2006 | — | — | — | — | ||||||||||||

| President and Chief | |||||||||||||||||

| Executive Officer | |||||||||||||||||

| Michael R. Cox | 2006 | $ | 153,000 | — | $ | 4,182 | (3) | — | |||||||||

| Vice President, Finance and | 2005 | $ | 152,500 | — | $ | 4,279 | (3) | — | |||||||||

| Chief Financial Officer | 2004 | $ | 76,728 | — | — | 50,000 | |||||||||||

| Ronald E. Shoup, Ph.D | 2006 | $ | 132,572 | $ | 12,896 | $ | 9,124 | — | |||||||||

| Chief Operating Officer, BASi | 2005 | $ | 128,133 | — | $ | 7,946 | (3) | — | |||||||||

| Contract Research Services | 2004 | $ | 124,000 | — | $ | 7,594 | (3) | 40,000 | |||||||||

| Edward M. Chait, Ph.D | 2006 | $ | 150,461 | — | — | — | |||||||||||

| Executive Vice President | 2005 | $ | 25,000 | (2) | — | — | 50,000 | ||||||||||

| Candice B. Kissinger | 2006 | $ | 107,697 | $ | 10,588 | $ | 28,435 | (1) | — | ||||||||

| Senior Vice President, Research; | 2005 | $ | 105,193 | — | $ | 27,597 | (1) | — | |||||||||

| Secretary and Director | 2004 | $ | 101,800 | — | $ | 22,401 | (1) | 30,000 | |||||||||

| (1) | Includes premiums paid on a life insurance policy on the life of Dr. Kissinger and Mrs. Kissinger, the beneficiary of which is a trust established for their benefit, in the amount of $20,865 in each of 2006, 2005 and 2004 and contributions to BASi’s 401(k) plan on Dr. Kissinger and Mrs. Kissinger, respectively. |

| (2) | Compensation is from August 1, 2005, the date Dr. Chait’s employment with BASi was initiated. |

| (3) | All other compensation contributions for Mr. Cox, Dr. Shoup and Dr. Silvon were to BASi’s 401(k) plan on their behalf, respectively. |

| (4) | Joined Company in October, 2006. |

There were no option grants of options, restricted stock or stock appreciation rights in fiscal 2003.

| Fiscal Year | Salary | Bonus | All Other Compensation | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Peter T. Kissinger, Ph.D | 2003 | $ | 30,683 | $ | --- | $ | 22,829 | (1) | ||||||

| Chairman of the Board, President | 2002 | $ | 101,001 | $ | --- | $ | 28,067 | (1) | ||||||

| and Chief Executive Officer | 2001 | $ | 85,000 | $ | 16,000 | $ | 25,965 | (1) | ||||||

| Ronald E. Shoup, Ph.D | 2003 | $ | 112,700 | $ | --- | $ | 6,837 | (2) | ||||||

| Chief Operating Officer, BASi Contract | 2002 | $ | 113,000 | $ | --- | $ | 7,438 | (2) | ||||||

| Research Services; Director | 2001 | $ | 108,000 | $ | 18,000 | $ | 6,403 | (2) | ||||||

| Candice B. Kissinger | 2003 | $ | 94,300 | $ | --- | $ | 26,900 | (3) | ||||||

| Senior Vice President & Research Director, | 2002 | $ | 90,700 | $ | --- | $ | 27,822 | (3) | ||||||

| Secretary and Director | 2001 | $ | 85,200 | $ | 18,000 | $ | 26,073 | (3) | ||||||

| Michael P. Silvon, Ph.D | 2003 | $ | 98,500 | $ | --- | $ | 6,304 | (4) | ||||||

| Interim Chief Financial Officer; | 2002 | $ | 94,800 | $ | --- | $ | 7,074 | (4) | ||||||

| Vice President, Planning and Development | 2001 | $ | 88,800 | $ | 16,000 | $ | 5,434 | (4) | ||||||

(1) Includes premiums paid on a life insurance policy onto the life of Dr. Kissinger and Mrs. Kissinger, the beneficiary of which is a trust established for their benefit,Named Executive Officers in the amount of $20,865 in each of 2003, 2002 and 2001 and contributions to BASi’s 401(k) plan on Dr. Kissinger’s behalf.fiscal year ended September 30, 2006.

(2) Represents contributions to BASi’s 401(k) plan on Dr. Shoup’s behalf.6

(3) Includes premiums paid on a life insurance policy on the lives of Mrs. Kissinger and Dr. Kissinger, the beneficiary of which is a trust established for their benefit, in the amount of $20,865 in each of 2003, 2002 and 2001 and contributions to BASi’s 401(k) plan on Mrs. Kissinger’s behalf

(4) Represents contributions to BASi’s (401k) plan on Dr. Silvon’s behalf.

Aggregated Option Exercises In Last Fiscal Year Andand Fiscal Year-End Option Values

The following table sets forth certain information concerning exercisable and unexercisable options held by the Named Executive Officers at September 30, 2003:2006:

| Number of Securities Underlying Unexercised Options at September 30, 2006 | Value of Unexercised In-the-Money Options at September 30, 2006(1) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Shares Acquired on Exercise | Value Realized ($) | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||||||

| Peter T. Kissinger | — | — | — | — | — | — | ||||||||||||||

| Ronald E. Shoup | — | — | 27,000 | 20,000 | $ | 18,030 | $ | 15,000 | ||||||||||||

| Edward M. Chait | — | — | 37,500 | 12,500 | — | — | ||||||||||||||

| Michael R. Cox | — | — | 37,500 | 12,500 | $ | 25,500 | $ | 8,500 | ||||||||||||

| Candice B. Kissinger | — | — | 11,000 | 20,000 | $ | 5,510 | $ | 4,500 | ||||||||||||

10

| Number of Securities Underlying Unexercised Options At September 30, 2003 | Value of Unexercised In-The-Money Options At September 30, 2003(1) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Shares Acquired on Exercise (#) | Value Realized ($) | Exerciseable | Unexerciseable | Exerciseable | Unexerciseable | |||||||||||||||

| Peter T. Kissinger, Ph.D. | --- | --- | --- | --- | --- | --- | ||||||||||||||

| Candice B. Kissinger | --- | --- | 750 | 250 | --- | --- | ||||||||||||||

| Ron E. Shoup, Ph.D. | 15,057 | $ | 21,961 | 6,250 | 750 | $ | 9,675 | $ | 3,225 | |||||||||||

| Michael P. Silvon, Ph.D. | --- | --- | 3,500 | 500 | $ | 6,450 | $ | 2,150 | ||||||||||||

(1) Calculated on the basis of $4.30

| (1) | Calculated on the basis of $5.26 per share, which was the closing price of the common shares as reported on the NASDAQ National Market System on September 30, 2006. |

Employment Agreements

Michael R. Cox Employment Agreement On April 1, 2004, the Company entered into an Employment Agreement with Michael R. Cox, pursuant to which the Company agreed to employ Mr. Cox as the Chief Financial Officer of the Company through September 30, 2006. After September 30, 2006, the Employment Agreement is automatically extended for successive one year periods, until such time as either Mr. Cox or the Company gives the other party ninety days’ written notice before the end of the term, at which time, the Employment Agreement will expire at the end of the current term. The Company also agreed to pay Mr. Cox a base salary of $12,500.00 per month, and granted Mr. Cox options to purchase 25,000 common shares under the 1997 Employee Incentive Option Plan and non-qualified options to purchase 25,000 shares of common stock. Mr. Cox is subject to a confidentiality restriction during his employment and thereafter, and to non-solicitation restrictions with respect to customers and employees of BASi during his employment and for two years following termination.

The Company may, in its sole and absolute discretion, terminate Mr. Cox’s employment with the Company without cause, by providing ninety days’ written notice to Mr. Cox. In the event of a termination without cause, Mr. Cox will be paid his then current annual salary throughout the ninety-day notice period and for a period of six months thereafter, and will also be paid for all vacation time accrued as reported onof the NASDAQ National Market System on September 30, 2003.termination date. If Mr. Cox’s employment is terminated by the Company with cause (as defined in the Employment Agreement), the Company is not obligated to make any further payments to Mr. Cox.

Edward M. Chait Employment Agreement On August 1, 2005, the Company entered into an Employment Agreement with Edward M. Chait, pursuant to which the Company agreed to employ Mr. Chait as the Executive Vice President, Chief Science Officer of the Company through July 31, 2007. After July 31, 2007, the Employment Agreement is automatically extended for successive one year periods, until such time as either Mr. Chait or the Company gives the other party ninety days’ written notice before the end of the term, at which time the Employment Agreement will expire at the end of the current term. The Company also agreed to pay Mr. Chait a base salary of $12,500.00 per month, and granted Mr. Chait options to purchase 25,000 common shares under the 1997 Employee Incentive Option Plan and non-qualified options to purchase 25,000 shares of common stock. Mr. Chait is subject to a confidentiality restriction during his employment and thereafter, and to non-solicitation restrictions with respect to customers and employees of BASi during his employment and for two years following termination.

At any time after July 31, 2007, the Company may, in its sole and absolute discretion, terminate Mr. Chait’s employment with the Company without cause, by providing ninety days’ written notice to Mr. Chait. In the event of a termination without cause, Mr. Chait will be paid his then current annual salary throughout the ninety-day notice period and for a period of six months thereafter, and will also be paid for all vacation time accrued as of the termination date. If Mr. Chait’s employment is terminated by the Company with cause (as defined in the Employment Agreement), the Company is not obligated to make any further payments to Mr. Chait.

7

Richard M. Shepperd Employment Agreement. On September 25, 2006, Mr. Shepperd was elected as the President and Chief Executive Officer of BASi, and the Compensation Committee determined Mr. Shepperd’s compensation. On January 11, 2007, the Board of Directors ratified the decision of the Compensation Committee and approved a written Employment Agreement with Richard M. Shepperd to memorialize the terms approved by the Compensation Committee effective October 2, 2006, the date Mr. Shepperd began his active employment with BASi. Pursuant to the Employment Agreement, BASi agreed to employ Mr. Shepperd as the President and Chief Executive Officer of BASi through February 28, 2007. After February 28, 2007, the Employment Agreement is automatically extended for successive three-month periods, until such time as either Mr. Shepperd or BASi gives the other party thirty days’ written notice before the end of the term, at which time the Employment Agreement will expire at the end of the then-current term. BASi agreed to pay Mr. Shepperd a base salary of $35,000.00 per month, plus a quarterly bonus equal to 10% of BASi’s annual earnings before interest, taxes, depreciation and amortization, capped at $150,000 per quarter. Mr. Shepperd will also be eligible for a discretionary, performance-based bonus determined by the Board of Directors to be paid at the end of his term of service. In addition to reimbursement of business expenses in accordance with BASi’s standard reimbursement policies, Mr. Shepperd will be entitled to reimbursement for reasonable expenses for living quarters in the Lafayette, Indiana area during the term of his employment, travel to and from his residence in the Henderson, Nevada area once per month, Mr. Shepperd is subject to a confidentiality restriction during his employment and thereafter, and to non-solicitation restrictions with respect to customers and employees of BASi during his employment and for two years following termination.

BASi may, in its sole and absolute discretion, terminate Mr. Shepperd’s employment with BASi, with or without cause, by providing five days’ written notice to Mr. Shepperd. In the event of termination, Mr. Shepperd will be paid his salary and a pro-rata portion of any quarterly bonus through the termination date, and will also be paid for all vacation time accrued as of the termination date.

Equity Compensation Plan Information

BASi maintains stock option plans that allow for the granting of options to certain key employees and directors of BASi. The following table gives information about equity awards under the stock option plans of BASi:

| Plan Category | Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance under the Equity Compensation Plan (Excluding Securities Reflected in First Column) | Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance under the Equity Compensation Plan (excluding Securities Reflected in First Column) | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 103,527 | $ | 4 | .60 | 320,750 | |||||||||||||||||

| Equity compensation plans not approved by security holders | 3,000 | $ | 8 | .00 | --- | |||||||||||||||||

| Equity compensation plans approved | ||||||||||||||||||||||

| by security holders | 353,870 | $ | 4 | .96 | 300,373 | |||||||||||||||||

| Equity compensation plans not approved | ||||||||||||||||||||||

| by security holders | 50,000 | $ | 5 | .14 | — | |||||||||||||||||

| Total | 106,527 | $ | 4 | .70 | 320,750 | 403,870 | $ | 4 | .98 | 300,373 | ||||||||||||

For additional information regarding the Company’sBASi’s stock option plans, please see Note 98 in the Notes to Consolidated Financial Statements in the Company’sBASi’s Annual Report on Form 10-K for the fiscal year ended September 30, 2003,2006, which is incorporated herein by reference.

Report of the Compensation and Incentive Stock Option Committee

Peter T. Kissinger, Candice B. Kissinger and

William E. Baitinger, Leslie B. Daniels and David W. Crabb serve on the Compensation Committee.and Incentive Stock Option Committee (the “Compensation Committee”). The Compensation Committee has responsibility for the administration of BASi’s executive compensation program. Dr. Kissinger, the President and Chief Executive Officer of BASi, does not participate in decisions regarding his compensation. None of BASi’s executive officers serves as a director of, or in any compensation-related capacity for, companies with which members of the Compensation Committee are affiliated.

The following report is submitted by the members of the Compensation Committee:

8

BASi’s executive compensation program is designed to align executive compensation with financial performance, business strategies and the values and objectives of BASi. BASi’s compensation philosophy is to ensure that the delivery of compensation, both in the short and long term, is consistent with the sustained progress, growth and profitability of BASi and acts as an inducement to attract and retain qualified individuals. This program seeks to enhance the profitability of BASi, and thereby enhance shareholder value, by linking the financial interests of BASi’s executives with those of its long-term shareholders. Under the guidance of BASi’s Compensation Committee, BASi has developed and implemented an executive compensation program to achieve these objectives while providing executives with compensation opportunities that are competitive with companies of comparable size in related industries.

11

BASi’s executive compensation program has been designed to implement the objectives described above and is comprised of the following fundamental elements:

Base Salary.Salary. The salary, and any periodic increase thereof, of the President and Chief Executive Officer were and are determined by the Board of Directors of BASi, excluding Dr. Kissinger, based on recommendations made by the Compensation Committee, excluding Dr. Kissinger.Committee. The salaries, and any periodic increases thereof, of all other executive officers were and are also determined by the Board of Directors based on Compensation Committee recommendations.

BASi, in establishing base salaries, levels of incidental and/or supplemental compensation, and incentive compensation programs for its officers and key executives, assesses periodic compensation surveys and published data covering both the BASi industry and other industries. The level of base salary compensation for officers and key executives is determined by both the scope of their responsibility and the salary ranges for officers and key executives of BASi established by the Board of Directors and the Compensation Committee. Periodic increases in base salary are dependent on the executive’s proficiency of performance in the individual’s position for a given period and on the executive’s competency, skill and experience.

On his own initiative the fiscal 2003 compensation level for the President and Chief Executive Officer was significantly reduced and redistributed to select BASi staff. Dr. Kissinger has expressed his intention to stay at this compensation level until BASi’s financial performance improves. Base salary increases for other eligible BASi staff were distributed in the first fiscal quarter of 2006.

Dr. Kissinger’s annual base salary for the period October 1, 2004 to December 1, 2004 was $104,200 with an adjustment to $108,376.08 on December 1, 2004. No additional increases have occurred in fiscal year 2006.

Bonus.Bonus. In years in which the after-tax net income of BASi exceeds an increase of 7% of revenue,over the previous year’s after-tax net income, the Compensation Committee is authorized to award bonuses to any BASi employee at the Committee’s discretion. Bonuses may also be awarded at the discretion of the Board of Directors.

12

Option Plans.Plans. Granting of options pursuant to BASi’s option plans is intended to align executive interest with the long-term interests of shareholders by linking executive compensation with enhancement of shareholder value. In addition, grants of options motivate executives to improve long-term stock market performance by allowing them to develop and maintain a significant long-term equity ownership position in BASi’s common shares. NoIn fiscal 2006 no options to purchase shares were granted to executives or staff in fiscal 2003.awarded.

| Respectfully submitted, William E. Baitinger, David W. Crabb and Leslie B. Daniels |

Respectfully submitted, Peter T. Kissinger Candice B. Kissinger William E. Baitinger

9

Audit Committee Report

The Audit Committee reviews BASi’s financial reporting process on behalf of the Board of Directors.Directors (the “Audit Committee”), of which Messrs. Baitinger, Daniels and Crabb are currently members, is responsible for selecting our independent auditors, reviewing the scope of the audit engagement and the results of the audit, approving permitted non-audit services provided by our independent auditors, reviewing our internal disclosure processes, overseeing our financial reporting activities and the accounting practices and policies followed in such reporting, overseeing complaints by employees and others as to BASi’s financial reporting, and the compliance by our employees with applicable laws, and other matters as the Board of Directors or the Audit Committee deems appropriate. The Audit Committee met five times during the year ended September 30, 2006. In fulfilling its responsibilities, the Audit Committee has reviewed the audited financial statements contained in the Annualannual Report on Form 10-K for the fiscal year ended September 30, 20032006 with BASi’s management and the independent auditors.registered public accountants. These reviews included quality, not just acceptability, of accounting principles, reasonableness of significant judgments, and clarity of disclosures in financial statements. Management is responsible for the financial statements and the reporting process, including administering the systems of internal control. The independent auditors are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States.

The Audit Committee discussed with the independent auditors,registered public accountants, the matters required to be discussed by Statement on Auditing Standardsstandards No. 61, Communication with Audit Committees, as amended. In addition, the Audit Committee has discussed with the independent auditors the auditors’registered public accountants their independence from BASi and its management, including the matters in the written disclosures required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as amended, and considered the compatibility of non-audit services with the auditors’auditor’s independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in BASi’s Annual Report on Form 10-K for the fiscal year ended September 30, 20032006 for filing with the SEC,Securities and the Board has so approved the audited financial statements.Exchange Commission.

Respectfully submitted, William E. Baitinger Leslie B. Daniels W. Leigh Thompson

| Respectfully submitted, William E. Baitinger, David W. Crabb and Leslie B. Daniels |

1310

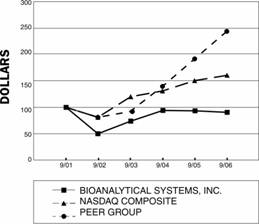

Stock Price Performance Graph

The following line graph below compares yearly percentage change in the cumulative total share stockholder return on BASi’s common shares against the cumulative total return on the NASDAQ Composite Index and a composite index based on a group of tennine publicly traded contract research and chemical instrumentation organizations (the “Peer Group Index”) for the period commencing September 30, 19982001 and ending September 30, 2003.2006.

The Peer Group Index is comprised of: • AAIpharma, Covalent Group, Inc.; • Bioreliance Corporation; • Covance, Kendle International, Inc.; • Kendle International; • Isco, Inc.; • Molecular Devices Corporation; • New Brunswick Scientific Co., Inc.; • Molecular Devices; Pharmaceutical Product Development, Inc.; OI Corporation; • Covalent Group,Corp.; Covance, Inc.; Gene Logic, Inc.; and • Pharmaceutical Product Development, Bio-Rad, Inc.

The comparison of total return on investment (change in year-end stock price plus reinvested dividends) for the applicable period assumes that $100 was invested on September 30, 19982000 in each of BASi, the NASDAQ Composite Index and the Peer Group Index.

Comparison of Cumulative Total ReturnCOMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURNamong Bioanalytical Systems, Inc.AMONG BIOANALYTICAL SYSTEMS, INC., theTHE NASDAQComposite Index and the Peer Group IndexCOMPOSITE INDEX AND A PEER GROUP

| 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bioanalytical Systems, Inc. | 100 | .00 | 57 | .00 | 50 | .00 | 109 | .00 | 57 | .00 | 80 | .00 | ||||||||

| Nasdaq Composite Index | 100 | .00 | 173 | .00 | 231 | .00 | 94 | .00 | 74 | .00 | 113 | .00 | ||||||||

| Peer Index | 100 | .00 | 74 | .00 | 131 | .00 | 98 | .00 | 91 | .00 | 110 | .00 | ||||||||

* $100 invested on September 30, 2001 in stock or index-including reinvestment of dividends. Fiscal year ending September 30.

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bioanalytical Systems, Inc. | 100 | .00 | 52 | .91 | 73 | .65 | 94 | .01 | 92 | .98 | 90 | .07 | ||||||||

| Nasdaq Composite Index | 100 | .00 | 80 | .97 | 120 | .85 | 131 | .16 | 150 | .08 | 159 | .80 | ||||||||

| Peer Index | 100 | .00 | 79 | .76 | 92 | .15 | 140 | .13 | 192 | .60 | 244 | .80 | ||||||||

1411

Compliance with Reporting Requirements of Section 16(a) of the Securities Exchange Act of 1934Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the BASi directors and executive officers and persons who beneficially own more than ten percent of a registered class of the BASi equity securitiesBASi’s Common Shares to file with the SEC initial Securities and Exchange Commission (”SEC”)reports showing ownership of ownership and reports of changes in ownership of common sharesBASi Common Shares and other equity securitiessecurities. On the basis of BASi. Officers, directors and greater-than-ten-percent shareholders are required by SEC regulation to furnish BASi with copies of all Section 16(a) reports they file. Except as set forth below and based solely upon the review of Section 16(a) reports furnished to BASi during or with respect to fiscal 2003 and written representationsinformation submitted by the BASi officers, directors and greater-than-ten-percent beneficial ownersexecutive officers, BASi believes that no other reports wereits directors and executive officers timely filed all required BASi is not aware of any instance of noncompliance or late compliance with Section 16(a) during or with respectfilings for fiscal 2006 and (except as disclosed in prior years’ proxy statements) for prior years, except for the inadvertent failure of Mr. Baitinger to fiscal 2003.

Mr. Daniels was late in filing a Form 3. Messrs. Baitinger, Thompson and Kraeutler each was late filing atimely file one Form 4 relating to certain option grants in June, 2003. Each of them attempted to file the Form 4 to report this grant in a timely fashion, but the original paper filings were rejected by the SEC pursuant to SEC Release No. 33-8235. Messrs. Baitinger, Thompson and Kraeutler are in the process of filing these Form 4s.for three transactions.

Communications with the Board of Directors

Currently, BASi shareholders may send communications for the Board of Directors directly to Peter T. Kissinger, Chairman of the Board of Directors, under the “Ask Pete” portion of the BASi website found athttp://www.bioanalytical.com/. The Board of Directors is also in the process of implementing a www.bioanalytical.com. Any shareholder communication policy in orderwho desires to better facilitate communications between shareholders and allcontact members of the Board of Directors.Directors, including non-management members as a group, may do so by writing to:

Corporate Secretary, Bioanalytical Systems, Inc.

2701 Kent Avenue

West Lafayette, IN 47906

corporatesecretary@bioanalytical.com

The corporate secretary will collect all such communications and organize them by subject matter. Thereafter, each communication will be promptly forwarded to the appropriate board committee chairperson according to the subject matter of the communication. Communications addressed to the non-management members as a group will be forwarded to each non-management member of the board.

2. RATIFICATION OF Contacting the Audit Committee

Any person who would like to contact BASi for the purpose of submitting a complaint regarding accounting, internal accounting controls, or auditing matters may do so by writing to:

Chairman of the Audit Committee, William E. Baitinger

700 Sugarhill Drive

West Lafayette, IN 47906

(765) 743-1023

auditcommittee@bioanalytical.com

Upon receipt of a complaint, the Chairman of the Audit Committee will follow a review process and actions dictated in the Company’s Code of Business Conduct and Ethics.

SELECTION OF INDEPENDENT AUDITORS

Subject to ratification by the shareholders, theACCOUNTANTS

The BASi Audit Committee of the Board of Directors has selected Ernst & Young LLPengaged Crowe Chizek and Company LLC (“Crowe”) as BASi’s independent auditors for BASipublic accountants for the fiscalaudit of financial statements for the year ending September 30, 2004.2006. As previously reported by BASi has been advisedon a Form 8-K filed with the SEC on September 14, 2006, BASi’s prior independent accountants, KPMG LLC (”KPMG”) resigned effective September 14, 2006. As reported on a Form 8-K filed with the SEC on November 1, 2006, the Audit Committee engaged Crowe on October 30, 2006.

The reports of KPMG for the fiscal years ended September 30, 2005 and 2004, contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles. In connection with its audits for the fiscal years ended September 30, 2005 and 2004 and through September 15, 2006, there were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of KPMG, would have caused them to make reference to the subject matter of the disagreement in connection with their report on the financial statements for such period.

12

During the fiscal years ended September 30, 2006 and 2005, there were no reportable events (as defined in Regulation S-K, Item 304(a) (1) (v)), except for a material weakness in BASi’s internal control at June 30, 2006 which was identified by such firmKPMG and disclosed in Item 9 in the BASi Annual Report on Form 10-K for the year ended September 30, 2006. KPMG noted certain conditions involving BASi’s internal control and its operation that neither it nor anyKPMG considered to be “material weaknesses.” “Material weakness” was defined in a letter from KPMG to BASi as “a control deficiency, or combination of control deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected by the entity’s internal control.” The material weaknesses noted by KPMG consisted of a failure to set an appropriate ”tone at the top” to instill a company-wide attitude of control consciousness; failure to maintain adequate procedures for anticipating and identifying financial reporting risks and for reacting to changes in its operating environment that could have a material effect on financial reporting; failure to maintain adequately trained personnel to perform effective review of accounting procedures critical to financial reporting; and a lack of adequately trained finance and accounting personnel with the ability to apply U.S. generally accepted accounting principles associated with the impairment of certain long-lived assets in accordance with Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. Management concurred with the assessment of KPMG. KPMG discussed the matters described in this paragraph with the BASi Audit Committee. BASi authorized KPMG to respond fully to the inquiries of its associates has any direct or material indirect financial interestsuccessor accountant concerning these matters.

KPMG also communicated to the Audit Committee in BASi.

The Board of Directors recommendsthe above-referenced letter that shareholders vote FOR ratification of the appointment of Ernst & Young LLP as independent auditors for fiscal year ending September 30, 2004. Unless authority to voteBASi had filed its Report on Form 10-Q for the ratificationthree- and nine-month periods ended June 30, 2006, prior to the completion of its interim review. KPMG subsequently completed its interim review and BASi filed an amended report on Form 10-Q/A for the appointmentthree- and nine-month periods ended June 30, 2006.

BASi engaged Crowe as its principal independent accountants effective as of Ernst & Young LLP as independent auditors for fiscal year ending SeptemberOctober 30, 20042006. At no time prior to October 30, 2006 had BASi consulted with Crowe regarding either: (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the BASi financial statements; or (ii) any matter that was either the subject of a disagreement (as that term is withheld,defined in Item 304(a)(1)(iv) of Regulation S-K and the accompanying proxy will be voted FOR such ratification.related instructions to that Item) or a reportable event (as that term is defined in Item 304(a)(1)(v) of Regulation S-K).

15

Ernst & Young LLP have acted as independent auditors for BASi since 1994. Representatives of Ernst & Young LLPCrowe are expected to be present at the Annual Meeting andMeeting. They will have the opportunity to make a statement if they desire to do so and will be available to respond toanswer appropriate questions concerning the auditsaudit of BASi’s financial statements.

| Audit Fees | 2006 | 2005 | ||||||

| Aggregate fees for annual audit, quarterly reviews | $350,000 | $365,000 | ||||||

| Tax Fees | 2006 | 2005 | ||||||

| Income tax services related to compliance with tax laws | $100,000 | $ 60,000 | ||||||

Audit Fees

| 2003 | 2002 | |||||||

|---|---|---|---|---|---|---|---|---|

| Aggregate fees for annual audit, quarterly reviews, | $ | 316,015 | $ | 180,081 | ||||

| SEC registration, and acquisitions | ||||||||

Tax Fees

| 2003 | 2002 | |||||||

|---|---|---|---|---|---|---|---|---|

| Income tax services related to compliance with tax laws | $ | 64,920 | $ | 50,425 | ||||

BASi’sBASi policies require that the scope and cost of all work to be performed for BASi by its independent auditorsregistered public accountants must be approved by the Audit Committee. Prior to the commencement of any work by the independent auditorregistered public accountants on behalf of BASi, the independent auditor providesregistered public accountants provide an engagement letter describing the scope of the work to be performed and an estimate of the fees. The Audit Committee and the Chief Financial Officer must review and approve the engagement letter and the estimate before authorizing the engagement. Where fees charged by the independent auditorregistered public accountants exceed the estimate, the Audit Committee must review and approve the excess fees prior to their payment.

13

3.2. OTHER MATTERS

As of the date of this proxy statement, the Board of Directors of BASi has no knowledge of any matters to be presented for consideration at the Annual Meeting other than those referred to above. If (a) any matters not within the knowledge of the Board of Directors as of the date of this proxy statement should properly come before the meeting; (b) a person not named herein is nominated at the meeting for election as a director because a nominee named herein is unable to serve or for good cause will not serve; (c) any proposals properly omitted from this proxy statement and the form of proxy should come before the meeting; or (d) any matters should arise incident to the conduct of the meeting, then the proxies will be voted in accordance with the recommendations of the Board of Directors of BASi.

| By Order of the Board of Directors, Candice B. Kissinger Secretary January 17, 2007 |

14

SIDE A

REVOCABLE PROXY

Bioanalytical Systems, Inc.

Annual Meeting of Shareholders to Be Held Thursday, February 15, 2007

The undersigned shareholder of Bioanalytical Systems, Inc. (“BASi”) hereby appoints Peter T. Kissinger, Lina Reeves-Kerner, and each of them as proxy for the undersigned, to vote all shares of BASi which the undersigned is entitled to vote at the Annual Meeting of Shareholders (the “Meeting”) of BASi to be held on Thursday, February 15, 2007, at 10:00 a.m., at the principal executive offices of BASi, 2701 Kent Avenue, West Lafayette, Indiana, or any adjournment thereof, in connection with all votes taken on the following proposal, described in the Proxy Statement received by the undersigned with the Notice of the Meeting.

1. | Proposal 1 – Approval of the election of the following individuals to the Board of Directors of BASi: William E. Baitinger, David W. Crabb, Leslie B. Daniels, Candice B. Kissinger and Peter T. Kissinger. |

For | |

Any shareholder may withhold authority to vote for any of the above-listed individuals by striking out the name of such individual. |

Proxy must be signed and dated. See reverse side.

SIDE B

PRESENTLY NO OTHER BUSINESS IS SCHEDULED TO BE PRESENTED AT THE MEETING. HOWEVER, BY SIGNING THIS PROXY YOU ARE GIVING THE HOLDER OF THIS PROXY DISCRETIONARY AUTHORITY TO ACT IN ACCORDANCE WITH THE DIRECTION OF THE BOARD OF DIRECTORS ON SUCH MATTERS.

This Proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this Proxy will be voted FOR Proposal 1 with respect to all votes taken on such proposal.

All Proxies previously given by the undersigned are hereby revoked. Receipt of Directors,the Notice of Meeting of Shareholders of the Company, the Proxy Statement, and the Company’s 2006 Annual Report is hereby acknowledged.

This Revocable Proxy may be revoked by the undersigned at any time before it is exercised by (i) executing and delivering to the Company a later-dated Proxy, (ii) attending the Meeting and voting in person, or (iii) giving written notice of revocation to the secretary of the Company.

Please date this Proxy and sign it exactly as your name appears on your stock certificate. If the shares are jointly held, both shareholders must sign. If signing as attorney, executor, administrator, guardian, or in any other representative capacity, please give your full title as such.

| DATED: | IF SHARES ARE JOINTLY HELD, BOTH SHAREHOLDERS MUST SIGN |

| (SIGNATURE) | (SIGNATURE) |

| PRINT NAME | PRINT NAME |

| ADDRESS | ADDRESS |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. PLEASE DATE, SIGN, AND RETURN AS SOON AS POSSIBLE IN THE ENCLOSED ENVELOPE. YOUR VOTE IS IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN.

Do you plan to personally attend the Annual Meeting of Shareholders? Yes No |

16